CC 2021 IN: Container chassis

Statement of Reasons—preliminary determinations

Concerning the preliminary determinations with respect to the dumping and subsidizing of container chassis originating in or exported from China.

Decision

Ottawa,

Pursuant to subsection 38(1) of the Special Import Measures Act, the Canada Border Services Agency made preliminary determinations on October 21, 2021 respecting the dumping and subsidizing of certain container chassis originating in or exported from China.

On this page

Summary of events

[1] On April 20, 2021, the Canada Border Services Agency (CBSA) received a written complaint from Max-Atlas Equipment International Inc. (Max Atlas) (hereinafter, the complainant), alleging that imports of certain container chassis from the People’s Republic of China (China) are being dumped and subsidized. The complainant alleged that the dumping and subsidizing have caused injury and are threatening to cause injury to the Canadian industry producing like goods.

[2] On May 11, 2021, pursuant to paragraph 32(1)(a) of the Special Import Measures Act (SIMA), the CBSA informed the complainant that the complaint was properly documented. The CBSA also notified the Government of China (GOC) that a properly documented complaint had been received. The GOC was provided with the non-confidential version of the subsidy complaint and was invited for consultations prior to the initiation of the subsidy investigation, pursuant to Article 13.1 of the Agreement on Subsidies and Countervailing Measures. A request for consultations was not received by the CBSA.

[3] The complainant provided evidence to support the allegations that container chassis from China have been dumped and subsidized. The evidence also disclosed a reasonable indication that the dumping and subsidizing have caused injury and/or are threatening to cause injury to the Canadian industry producing like goods.

[4] On June 10, 2021, pursuant to subsection 31(1) of SIMA, the CBSA initiated investigations respecting the dumping and subsidizing of container chassis from China.

[5] Upon receiving notice of the initiation of the investigations, the Canadian International Trade Tribunal (CITT) commenced a preliminary injury inquiry, pursuant to subsection 34(2) of SIMA, into whether the evidence discloses a reasonable indication that the dumping and subsidizing of the above-mentioned goods have caused injury or are threatening to cause injury to the Canadian industry producing the like goods.

[6] On August 9, 2021, pursuant to subsection 37.1(1) of SIMA, the CITT made a preliminary determination that there is evidence that discloses a reasonable indication that the dumping and subsidizing of container chassis from China have caused injury to the domestic industry.

[7] On September 1, 2021, in order to help alleviate the pressures brought on by the COVID-19 pandemic to interested parties, the CBSA extended the 90-day period for making the preliminary determinations or terminating all or part of the investigations to 135 days, pursuant to subsection 39(1) of SIMA.

[8] On October 21, 2021, as a result of the CBSA’s preliminary investigations and pursuant to subsection 38(1) of SIMA, the CBSA made preliminary determinations of dumping and subsidizing of container chassis originating in or exported from China.

[9] On the same date, pursuant to subsection 8(1) of SIMA, provisional duty was imposed on imports of dumped and subsidized goods that are of the same description as any goods to which the preliminary determinations apply, and that are released during the period commencing on the day the preliminary determinations were made and ending on the earlier of the day on which the CBSA causes the investigations in respect of any goods to be terminated pursuant to subsection 41(1) of SIMA or the day the CITT makes an order or finding pursuant to subsection 43(1) of SIMA.

Period of investigation

[10] The Dumping Period of Investigation (POI) is May 1, 2020 to April 30, 2021.

[11] The Subsidy POI is January 1, 2020 to April 30, 2021.

Profitability analysis period

[12] The Profitability Analysis Period (PAP) is May 1, 2020 to April 30, 2021.

Interested parties

Complainant

[13] The name and address of the complainant is as follows:

Max-Atlas Equipment International Inc.

371 chemin du Grand Bernier N

Saint-Jean-sur-Richelieu, QC J3B 4S2

[14] Max-Atlas is a manufacturer of container chassis and subassemblies used in a wide variety of industries including, but not limited to, the transportation, waste management and mobile energy (generators) industries, as well as the oil and gas industry for the transportation of frac sand in fracking operations. Max-Atlas also manufactures and sells parts and custom designed chassis.Footnote 1

Other producers

[15] The other known manufacturers of like goods in Canada are:

| Company name | Address |

|---|---|

| Raja Trailer | 9108 River Rd Delta, BC V4G 1B5 |

| Innovative Trailer Design | 161 The West Mall Toronto, ON M9C 4V8 |

| Di-Mond | 195 Constellation Dr Stoney Creek, ON L8E 0J5 |

[16] Di-MondFootnote 2 and Innovative Trailer DesignFootnote 3 both support the complaint. Raja Trailer expressed a neutral opinion of the complaint.Footnote 4

Trade unions

[17] The complainant identified the Fédération démocratique de la métallurgie, des mines et des produits chimiques (FEDEM), as the union of which Max-Atlas’ employees are members. The complainant did not identify any additional trade unions.Footnote 5

Importers

[18] At the initiation of the investigations, the CBSA identified 86 potential importers of the subject goods based on both information provided by the complainant and CBSA import entry documentation. All of the potential importers were asked to respond to the CBSA’s Importer request for information (RFI).Footnote 6 The CBSA received two responses to the Importer RFI.

Exporters

[19] At the initiation of the investigations, the CBSA identified 22 potential exporters/producers of the subject goods originating in or exported from China from CBSA import documentation and from information submitted in the complaint. All of the potential exporters/producers were asked to respond to the CBSA’s Dumping RFI, Subsidy RFI and Section 20 RFI.Footnote 7

[20] In total, only one exporter responded to the RFIs, Dongguan CIMC Vehicle Co., Ltd. (DCVC), which is a subsidiary of China International Marine Containers Ltd. (CIMC). The CBSA also received responses to the RFI from other related companies within CIMC who did not export to Canada, but were involved as input suppliers, as well as one vendor located in the United States (US).

Government

[21] At the initiation of the investigations, the GOC was sent the CBSA’s Government Subsidy RFI requesting information concerning the alleged subsidy programs available to producers/exporters of subject goods. The GOC was also sent a Section 20 RFI.Footnote 8 The GOC did not respond to either the Government Subsidy RFI or Section 20 RFI.

[22] For the purposes of these investigations, GOC refers to all levels of government, i.e., federal, central, provincial/state, regional, municipal, city, township, village, local, legislative, administrative or judicial, singular, collective, elected or appointed. It also includes any person, agency, enterprise, or institution acting for, on behalf of, or under the authority of, or under the authority of any law passed by, the government of that country or that provincial, state or municipal or other local or regional government.

Product information

Definition

[23] For the purpose of these investigations, subject goods are defined as:

Container chassis and container chassis frames, whether finished or unfinished, assembled or unassembled, regardless of the number of axles, for the carriage of containers, or other payloads (including self-supporting payloads) for road, marine roll-on/roll-off and/or rail transport, and certain subassemblies of container chassis originating in or exported from the People’s Republic of China.

Excluding:

- dry van trailers, meaning trailers with a wholly enclosed cargo space comprised of fixed sides, nose, floor and roof, with articulated panels (doors) across the rear and occasionally at selected places on the sides, with the cargo space being permanently incorporated in the trailer itself

- refrigerated van trailers, meaning trailers with a wholly enclosed cargo space comprised of fixed sides, nose, floor and roof, with articulated panels (doors) across the rear and occasionally at selected places on the sides, with the cargo space being permanently incorporated in the trailer and being insulated, possessing specific thermal properties intended for use with self‐contained refrigeration systems and

- flatbed or platform trailers, meaning trailers that consist of load‐carrying main frames and a solid, flat or stepped loading deck or floor permanently incorporated with and supported by frame rails and cross members

For greater certainty, the subject goods include the following complete or substantially complete major subassemblies, when imported, purchased or supplied with, or for assembly with, subject container chassis frames:

- running gear assemblies for connection to the container chassis frame, whether fixed in nature or capable of sliding fore and aft or lifting up and lowering down, which may include suspension(s), wheel end components, slack adjusters, axles, brake chambers, locking pins, tires and wheels

- landing gear assemblies, for connection to the container chassis frame, capable of supporting the container chassis when it is not engaged to a tractor and

- connection assemblies that connect to the container chassis frame or a section of the container chassis frame, such as B-trains and A-trains, capable of connecting a container chassis to a converter dolly or another container chassis

Additional product informationFootnote 9

[24] Chassis are typically, but are not limited to, rectangular framed trailers with a suspension and axle system, wheels and tires, brakes, a lighting and electrical system, a coupling for towing behind a truck tractor, and a locking system or systems to secure the shipping container or containers to the chassis using twistlocks, slide pins or similar attachment devices to engage the corner fittings on the container or other payload.

[25] These chassis are typically used in the transportation of intermodal cargo containers and are skeletal rectangular framed trailers.Footnote 10 The rectangular frame comprises steel with a suspension and axle system, wheels and tires, brakes, a lighting and electrical system, a coupling for towing behind a truck tractor, and a locking system or systems to secure the shipping container or containers attached to the chassis. Chassis are designed to carry containers of various sizes, usually ranging from 20’ to 60’ in Canada, including the typical container lengths of 20’, 40’, 45’, 53’ and 60’. Containers carried on chassis include marine containers which are sometimes referred to as “ISO containers”, as they are manufactured to specifications set out by the International Organization for Standardization. Other containers carried by the subject goods include, but are not limited to, domestic containers designed to be carried exclusively over land and not via ocean transport, tank containers for the carriage of liquids or sand, flat racks which are containers without sides, generators for emergency systems and temporary power delivery and waste containers.

[26] Some chassis are built to a single container size and for holding a single container. Others are designed to be extendable chassis, meaning their sliding or adjustable suspension can be extended to allow for longer containers to be carried. Some longer chassis are designed to allow the operator to carry multiple smaller containers, allowing the operator the flexibility of carrying loads for multiple clients simultaneously.

[27] Chassis may be imported into Canada in a fully assembled form, or imported as an unassembled chassis, such as a chassis frame accompanied by the relevant subassemblies, with most or all of the integral items required to assemble a chassis into a finished form. For an unfinished or unassembled chassis to be considered subject goods, the parts for a single chassis do not have to enter at the same time.

[28] The subject container chassis frames are steel skeletal frames forming the main frame of the trailer and typically include: coupler plate assemblies, bolsters consisting of transverse beams with locking or support mechanisms, gooseneck assemblies, drop assemblies, extension frame assemblies with locking mechanisms and/or rear impact guards. These container chassis frames are only used to manufacture a finished container chassis.

[29] For greater certainty, the subject goods include unfinished or unassembled container chassis or container chassis frames, for painting, coating or further assembly with components such as, but not limited to hub and drum assemblies, brake assemblies (either drum or disc), axles, brake chambers, suspensions and suspension components, wheel end components, landing gear legs, spoke or disc wheels, tires, brake control systems, electrical harnesses and lighting systems.

[30] The subject goods do not include the individual components of the container chassis or subassemblies when imported as individual components, meaning not as part of an unassembled or unfinished container chassis or as part of a substantially complete subassembly. Such non-subject individual components may include hub and drum assemblies, brake assemblies (either drum or disc), axles, brake chambers, suspensions and suspension components, wheel end components, landing gear legs, spoke or disc wheels, tires, brake control systems, electrical harnesses and lighting systems. Some of these components may also be used in the production of non-subject trailers such as flatbeds, tankers, dumpers, grain hoppers and others.

[31] The processing of the subject goods, such as trimming, cutting, grinding, notching, punching, drilling, painting, coating, staining, finishing, assembly, bolting, welding or any other processing in China or another country does not remove the product from the definition of subject goods. In addition, if unfinished chassis manufactured in China are merely assembled into a completed chassis in a third country, such as the US or Mexico, the chassis remains subject to the scope of these investigations. The inclusion of additional components not identified as comprising the finished or unfinished container chassis does not remove the chassis from the definition of subject goods.

Production processFootnote 11

[32] The standard production process for chassis primarily involves the fabrication and assembly of welded steel parts.

[33] The chassis frame consists of welded steel parts in three basic subassemblies—the front, or forward beam and front cross-member, assembly, the middle assembly and the rear, or rear cross-member including the rear impact guard, assembly. The chassis frame subassemblies are composed of steel I-beams, fabricated beams from plates and flat bars, box beams, channels and angles that are cut and welded into the shape of the frame.

[34] The completed chassis also includes the running gear assembly, air brake system, and lighting and electrical systems.

[35] The running gear assembly comprises the tires, hub and drum assemblies, axles and suspensions, brake chambers and other components.

[36] Chassis producers use metal inert gas (MIG) welders to weld the various steel components together. The middle, or drop frame assembly, consists of the main longitudinal beams (cross-members) and may include diagonal bracing. Once the steel parts are assembled and coated, the air brake system and electrical components are added to the assembly. The final assembly of the product prior to delivery can be described as follows:

- The front/gooseneck assembly, in an orientation with the king pin facing upward, provides for access to attach the landing gear and cross-brace

- The mainframe with the operational top surface being inverted for access to the lower portion of the structure provides access to install the axle/wheel/tire portion of the suspension. In the case of a slider-type suspension, this can be done in the upright orientation. Additional wheel/tire combinations are also added to the axles at this stage, although typically a single wheel/tire is installed to each axle spindle with the pairing shipped free

- The front section and mainframes are then oriented upright and the connection just behind the landing gear is completed. This requires a support at the king pin area of the front section and a support near the forward location of the mainframe, in order to align for fastener placement

- The rear section, which can be comprised of the rear bolster and the rear impact guard, is secured to the rear portion of the main beam, behind the suspension

- The axle alignment procedure is then performed

- Air and electrical system connections are completed from section to section

- A final inspection, including light check, air brake timing tests and roadworthiness inspection is performed

Product useFootnote 12

[37] Container chassis are typically used in the transportation of intermodal cargo containers and are skeletal rectangular framed trailers.

Classification of imports

[38] The subject goods are normally imported under the following tariff classification number: 8716.39.30.90.

[39] Subject goods may also be imported under the following tariff classification numbers:

- 8716.39.30.20

- 8716.39.90.90

- 8716.90.30.00

- 8716.90.99.10

- 8716.90.99.90

[40] The listing of tariff classification numbers is for convenience of reference only. The tariff classification numbers include non-subject goods. Also, subject goods may fall under tariff classification numbers that are not listed. Refer to the product definition for authoritative details regarding the subject goods.

Like goods and class of goods

[41] Subsection 2(1) of SIMA defines “like goods” in relation to any other goods as goods that are identical in all respects to the other goods, or in the absence of any identical goods, goods the uses and other characteristics of which closely resemble those of the other goods.

[42] In considering the issue of like goods, the CITT typically looks at a number of factors, including the physical characteristics of the goods, their market characteristics and whether the domestic goods fulfill the same customer needs as the subject goods.

[43] With respect to the definition of like goods, the complainant stated that like goods are those goods described in the product definition. That is, domestically produced container chassis, which meet the product definition. Therefore, it does not include domestically produced goods which are specifically excluded from the product definition. The complainant noted CITT decisions in Hot-Rolled Carbon Steel Plate and Seamless Carbon or Alloy Steel Oil and Gas Well Casing, to support this position.Footnote 13 The complainant also submits that subject goods and like goods form a single class of goods.

[44] The complainant recognizes that the subject goods are marketed to different industries and applications, including the moving industry, firefighting, construction and utility equipment and the oil and gas industry. The complainant states that such differences in marketing, however, are not illustrative of different classes of goods. The specific models marketed for particular uses are not necessarily the only model which can effectively be used to complete the tasks the customer requires and are interchangeable with other models of chassis. According to the complainant, the fact remains that the function and role of the chassis are identical, namely the hauling of containers and goods.

[45] With respect to physical characteristics, the complainant stated that the subject goods and the like goods are all composed of the same materials, namely primary structures composed of welded steel beams, landing gear assemblies (the legs), running gear assemblies (the wheels) and the lighting and electrical assemblies (brake lights, etc.). The subject goods are substantially similar in appearance, often being effectively longer or shorter versions of each other.Footnote 14

[46] In terms of market characteristics, the complainant stated that the subject goods and like goods are all designed for use in the carriage of containers for road transport. In addition, chassis produced to the same dimensions or specifications are generally interchangeable. All chassis are sold through the same or similar channels of distribution, namely (1) end users (trucking companies, chassis rental companies, etc.) or (2) distributor networks. All chassis covered under the scope of this complaint are manufactured in common facilities, using similar production processes and the same production employees.Footnote 15

[47] After considering questions of use, physical characteristics and all other relevant factors, the CBSA is of the opinion that domestically produced container chassis, that are of the same description as subject goods, are like goods to the subject goods. Further, the CBSA is of the opinion that the subject goods and like goods constitute only one class of goods.

[48] In its preliminary injury inquiry for this investigation, the CITT further reviewed the matter of like goods and classes of goods. On August 24, 2021, the CITT issued its preliminary inquiry Statement of Reasons for this investigation, indicating that it would “[…] conduct its analysis on the basis that domestically produced goods meeting the product definition are like goods to the subject goods, and that there is one class of like goods.”Footnote 16

The Canadian industry

[49] The complaint includes data on domestic production and on domestic sales of container chassis for domestic consumption.Footnote 17 The CBSA also contacted all known potential producers of container chassis in Canada to gather further information concerning the domestic production of container chassis for domestic consumption.Footnote 18

[50] The CBSA received letters of support from Di-MondFootnote 19 and Innovative Trailer DesignFootnote 20. Raja Trailer expressed a neutral opinion of the complaint.Footnote 21 Of the companies contacted by the CBSA, the three identified above were the only confirmed producers of container chassis in Canada.

[51] The complainant and the supporting producers account for the vast majority of the domestic production of like goods.

Imports into Canada

[52] During the preliminary phase of the investigations, the CBSA refined the estimated volume and value of imports based on information from CBSA import entry documentation and information received from the exporter and importers.

[53] The following table presents the CBSA’s analysis of imports of container chassis for purposes of the preliminary determinations:

| Country | Dumping POI (May 1, 2020 to April 30, 2021) |

Subsidy POI (January 1, 2020 to April 30, 2021) |

|---|---|---|

| China | 85.2% | 82.8% |

| All other countries | 14.8% | 17.2% |

| Total imports | 100% | 100% |

Representations

[54] The CBSA did not receive any representations from parties to the proceeding during the preliminary phase of the investigations.

Investigation process

[55] Regarding the dumping investigation, information was requested from all known and potential exporters, producers, vendors and importers, concerning shipments of container chassis released into Canada during the POI.

[56] Regarding the section 20 inquiry, information was requested from all known and potential exporters and producers of container chassis in China and from the GOC. The CBSA also sent Surrogate RFIs to all known producers of container chassis in Mexico, Turkey and the US to collect domestic pricing and costing information concerning container chassis to determine normal values under paragraph 20(1)(c) of SIMA. Furthermore, importers were requested to provide information respecting re-sales in Canada of like goods imported from a third country in order to gather information to determine normal values under paragraph 20(1)(d) of SIMA.

[57] Regarding the subsidy investigation, information related to potential actionable subsidies was requested from all known and potential exporters and producers in China. Information was also requested from the GOC concerning financial contributions made to exporters or producers of container chassis released into Canada during the POI. The GOC was also requested to forward the RFIs to all subordinate levels of government that had jurisdiction over the exporters.

[58] The GOC and the exporters/producers were also notified that failure to submit all required information and documentation, including non-confidential versions, failure to comply with all instructions contained in the RFI, failure to permit verification of any information or failure to provide documentation requested during the verification visits or the desk audits may result in the margin of dumping, the amount of subsidy and the assessment of dumping and/or countervailing duties on subject goods being based on facts available to the CBSA. Further, they were notified that a determination on the basis of facts available could be less favorable to them than if complete, verifiable information was made available.

[59] The CBSA received a request for an extension to the deadline for the dumping, subsidy and section 20 RFIs from one exporter/producer located in China. The CBSA reviewed the request and granted the extension as the reasons for making the request constituted unforeseen circumstances or unusual burdens.

[60] Preliminary determinations are based on the information available to the CBSA at the time of the preliminary determinations. During the final phase of the investigations, the CBSA will continue to collect and verify information, the results of which will be incorporated into the CBSA’s final decisions, which must be made by January 19, 2022.

Dumping investigation

Background of the section 20 inquiry

[61] Section 20 is a provision of SIMA that may be applied to determine the normal value of goods in a dumping investigation where certain conditions prevail in the domestic market of the exporting country. In the case of a prescribed country under paragraph 20(1)(a) of SIMA, it is applied where, in the opinion of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.Footnote 22

[62] The provisions of section 20 are applied on a sector basis rather than on the country as a whole. The CBSA proceeds on the presumption that section 20 of SIMA is not applicable to the sector under investigation absent sufficient information to the contrary. The CBSA may form an opinion where there is sufficient information that the conditions set forth in paragraph 20(1)(a) of SIMA exist in the sector under investigation.

[63] The CBSA is required to examine whether the government of that country substantially determines domestic prices. The CBSA is also required to examine the price effect resulting from substantial government determination of domestic prices and whether there is sufficient information on the record for the CBSA to have reason to believe that the resulting domestic prices are not substantially the same as they would be in a competitive market.

[64] The complainant alleged that the conditions described in section 20 prevail in the semi-trailer industry sector, which includes container chassis, in China. That is, the complainant alleged that this industry sector in China does not operate under competitive market conditions and consequently, prices established in the Chinese domestic market for container chassis are not reliable for determining normal values.

[65] The complainant provided evidence supporting the claim that the GOC substantially determines prices of semi-trailers sold in China, including a pricing analysis.Footnote 23

[66] For the purposes of this section 20 inquiry, the sector under review is the semi-trailer sector within the transportation vehicle industry in China. The semi-trailer sector is segmented into flatbed, refrigerated, dry van, container chassis and other vehicle type. The subject goods are container chassis and their subassemblies within the semi-trailer industry.

[67] At the initiation of the investigation, the CBSA had sufficient evidence, supplied by the complainant and from its own research and past investigation findings, to support the initiation of a section 20 inquiry to examine the extent of GOC involvement in pricing in the semi-trailer industry sector, which includes container chassis. The information indicated that prices in China in this sector have been influenced by various GOC industrial policies and measures.

[68] Consequently, the CBSA sent Section 20 RFIs to producers and exporters of container chassis in China as well as the GOC, to obtain information on the extent to which the GOC is involved with the determination of domestic prices in the semi-trailer industry sector, which includes container chassis. A surrogate producer RFI was sent to producers in the surrogate countries: Mexico, Turkey and the US to gather information to be used for the purposes of determining normal values pursuant to paragraphs 20(1)(c) of SIMA.

[69] The CBSA selected the US and Mexico as surrogate countries as both countries have significant domestic production of container chassis and represent the highest volumes of container chassis exported to Canada. For the purposes of identifying additional countries, the CBSA examined countries with economic or geographic characteristics comparable to China. Of these countries, the CBSA found that Turkey was the most appropriate surrogate given the reasonably comparable economic conditions and the existence of a developed container chassis industry.

Summary of Chinese exporter responses

[70] The CBSA received one substantially complete response to the section 20 RFI from DCVC. The response included submissions from DCVC’s relevant related suppliers and a related vendor.

[71] CIMC is a world leading supplier engaged in the manufacture of transportation equipment and the provision of logistics and energy solutions. CIMC also manufactures and sells a variety of shipping containers, including dry cargo containers, reefers, and other specialty containers. CIMC Vehicles, one of the subsidiaries of CIMC and the largest producer of chassis in the world, has 22 manufacturing plants and 10 assembly plants globally, producing a variety of semi-trailers and special truck bodies for transportation vehicles and shipping containers.

Government of China response

[72] An RFI was sent to the GOC requesting information for the purposes of the section 20 inquiry. No response was received from the GOC as of the date of the preliminary determination of dumping.

Surrogate country responses

[73] As part of the section 20 inquiry, Surrogate Producer RFIs were sent to all known producers of container chassis in Mexico, Turkey and the US. However, no response to the surrogate RFI was received during the phase of preliminary determination.

Responses from importers with sales in Canada of container chassis from other countries

[74] As part of the section 20 inquiry, RFIs sent to importers requested information on re-sales in Canada of container chassis imported from countries other than China. The CBSA received responses to the importer RFI from two importers. None of the importers provided information on re-sales in Canada of like goods from non-subject countries.

Analysis of section 20 conditions

[75] As the GOC did not respond to the section 20 RFI, information with respect to product mix, production volume and market share of semi-trailer manufacturers in the sector is not available at this stage. The CBSA analyzes section 20 factors and conditions in China with a focus on CIMC, whose subsidiary DCVC is the only exporter responding to the section 20 RFI.

Government control analysis

[76] The following is the CBSA’s analysis of the relevant factors that are present in the semi-trailer industry sector in China, which includes container chassis.

- 13th Five-Year National Plan on National Economic and Social Development

- 13th Five-Year Comprehensive Transportation Service Development Plan

- Belt and road initiative and Made-in-China 2025 initiative

- Vehicle Industry Investment Regulations

- GOC’s ownership and control of semi-trailer producers

- GOC’s ownership of suppliers of raw materials and the influence over inputs

- Existence of non-market conditions in sectors of other semi-trailer assemblies

- Subsidization of the semi-trailer and steel industry and

- Preferential tax treatment of semi-trailer purchase

[77] On the level of overall administrative control, the direction of the Chinese economy is governed by a complex system of industrial planning which affects all economic activities within the country. The totality of these plans covers a comprehensive and complex matrix of sectors and crosscutting policies and is present on all levels of government. Two plans and two initiatives discussed below exemplify how individual industrial sectors such as semi-trailer segment and/or its related projects are being singled out as priorities in line with the government priorities and specific development goals are attributed to industrial upgrade and international expansion etc.

13th Five-Year Plan on National Economic and Social Development

[78] Five-Year Plans are an important economic policy tool within the Chinese socialist market economy. Within each plan, the GOC maps out its strategies for economic development, setting growth targets and launching economic reforms with respect to key industries.

[79] The 13th Five-Year Plan on National Economic and Social Development (13th Five-Year Plan), adopted on March 15, 2016 emphasizes the importance of developing the logistics industry in several chapters for the period of 2016-2020, which covers semi-trailer products during the POI.Footnote 24 In particular, the 13th Five-Year Plan sets its goal to reduce enterprise logistics costs by improving logistics organization and managementFootnote 25, to strengthen the construction of logistics infrastructureFootnote 26, and to increase the overall efficiency of transportation and logisticsFootnote 27, which are closely related to the semi-trailer industry.

[80] The 13th Five-Year Plan, which recognizes the staggering impact of over-capacity on the industrial system, calls for reduction in supply in saturated sectors by merging, upgrading, and restructuring underperforming companies; reworking government subsidies that promote unprofitable manufacturing; and, ultimately, bankruptcy and liquidation of unprofitable companies.Footnote 28

[81] Guided in such a direction, CIMC Vehicles has acquired Yangzhou Tonghua Special Vehicle, Jinan Kogel Special Automobile and China's previous largest trailer maker, Huajun Group, which was listed as the 11th largest semi-trailer producer in the world based on the ranking published by Global Trailer in 2015.Footnote 29

[82] On July 4, 2016, the CIMC announced that it has solely taken over the Retlan Manufacturing Limited, the United Kingdom’s leading semi-trailer manufacturer and owners of SDC Trailer and MDF Engineering, at £91.7 million GBP. The mega-merger was the biggest in the global semi-trailer industry in the last ten years, which allowed CIMC to expand its business into Europe, and retain its position as a semi-trailer world leader.Footnote 30

[83] The 13th Five-Year Plan calls for greater involvement of state-owned enterprises (SOEs) in the development of the Chinese economy. Specifically, chapter 11 of the plan states:

“We will remain firmly committed to ensuring that SOEs grow stronger, better, and bigger and work to see that a number of such enterprises develop their capacity for innovation and become internationally competitive, thereby injecting greater life into the state-owned sector, helping it exercise a greater level of influence and control over the economy, increasing its resilience against risk, and enabling it to contribute more effectively to accomplishing national strategic objectives.”Footnote 31

[84] The plan expressly reiterated the GOC’s intention to use SOE to proactively interfere with market dynamics and exercise control over its economy and CIMC is found to be an SOE as discussed in the section of “GOC’s Ownership and Control of Semi-trailer Producers”.

13th Five-Year Comprehensive Transportation Service Development Plan

[85] To further specify the policies to achieve the 13th Five-Year Plan goals, the Chinese Ministry of Transport published the 13th Five-Year’ Comprehensive Transportation Service Development Plan in July 2016. One of the 11 main goals of this development plan is to build an intensive and efficient freight logistics system.Footnote 32 This is to be achieved by promoting the comprehensive development of drop-and-pull transport. The development plan further elaborates:

Encourage the development of standard van semi-trailers, and promote the improvement of relevant laws, policies and technical standards. Improve the facilities of standardized drop-and-pull transport stations and support the construction of large-scale public zero-load drop-and-pull dedicated stations. Encourage the innovation of "trailer pool" and other emerging logistics services, support the development of long-distance feeder drop-and-pull transportation, encourage the development of trailer leasing, trailer, trailer interchange and other businesses, and improve the related systems and regulations of trailer management.

[86] Drop-and-pull transport, also known as drop-and-hook or drop-and-pick, is a system of freight transport whereby a truck driver drops off a container (“drop”) and picks up another container (“pick” or “hook” or “pull”).

[87] The promotion of drop-and-pull transport also serves as a means to further other policy objectives, such as improvement in energy efficiency. In 2017, the State Council issued State Council on further promoting lower-cost higher-efficiency logistics, which once again puts emphasis on the promotion of multimodal transportation and drop-and-pull transportation related to the semi-trailer industry.Footnote 33

[88] The wide adoption of semi-trailer/container chassis is crucial for the promotion of drop-and-pull transport. In this regard, it is evident that the Chinese government has implemented a number of specific policies to promote the development and use of semi-trailers/container chassis.

Belt and Road Initiative and Made-in-China 2025 Initiative

[89] China’s Belt and Road Initiative (BRI), sometimes referred to as the New Silk Road, is one of the most ambitious global infrastructure and logistics development plan made up of a “belt” of overland corridors and a maritime “road” of shipping lanes. Launched in 2013, the vast collection of global trade network of overland routes, rail and ocean transportation, energy pipelines, and streamlined border crossings stretches from East Asia to Europe and Africa, including 71 countries that account for half the world’s population and a quarter of global GDP.

[90] As a manufacturer of containers, semi-trailer and other transportation products that are essential to China’s global trade network, CIMC plays a pivotal role in this policy agenda of the GOC. Reported by Supply and Demand Chain Executive on August 17, 2015, CIMC claimed:Footnote 34

The goal is to have all CIMC divisions supplying the container shipping, trucking, railway and logistics industries with global tracking, monitoring and remote asset management services and equipment. Our immediate target is China’s One Belt One Road initiative.

[91] On May 14, 2017 in the BRI Forum for International Cooperation, Mai Boliang, the CEO and president of CIMC, stated that CIMC is actively involved in the Belt and Road construction and strives to deliver premium and reliable equipment, services and solutions to the countries along the Belt and Road.Footnote 35

[92] On August 27, 2018, the State-owned Assets Supervision and Administration Commission of the State Council (SASACSC) had a news release about how CIMC (as a SOE in the BRI projects) backs logistics service for Belt and Road Initiative.Footnote 36

[93] CIMC has directly benefited from the demand for containers and semi-trailers created by Chinese-led logistics networks BRI. This increase in demand is not limited to only containers, it would also directly benefit CIMC’s sales of ancillary products such as subject container chassis and other semi-trailers as overland trade by road transport brings significant new demand for those products.

[94] Overlapping with the BRI is the Made-in-China Initiative 2025 (“MCI 2025”)Footnote 37, which was released by the State Council in 2015 and targets ten priority industries for promotion and development, among which are Ocean engineering equipment and high-tech shipping and modern rail transport equipment.

[95] As the MCI 2025 supports logistics and transportation companies in China to compete with global players, certain semi-trailers including chassis could benefit from MCI 2025 policies both directly and indirectly. For example, CIMC has benefited from MCI 2025 policies for developing robotics and machine tools with its automated lighthouse plants, which comprehensively realize smart manufacturing with digital modeling and automated production.Footnote 38

[96] The CEO of CIMC Vehicles stated outright in an interviewFootnote 39 that

with the general trend towards ‘Made in China 2025, the 25 subsidiaries of CIMC Vehicles will transform into lighthouse plants within the next three to five years based on the schedule.

[97] Although global economic activities were severely affected by the global outbreak and spread of COVID-19 in 2020, the total revenue of CIMC Vehicles increased 13% compared to 2019 and hit a record highFootnote 40 under the circumstance of all these polices and initiative to encourage transportation producers to remain globally competitive by satisfying domestic demands and serving developed markets.

Vehicle Industry Investment Regulations

[98] The Vehicle Industry Investment RegulationsFootnote 41, implemented on January 10, 2019 aim to promote high-quality development of the automotive industry by improving accessibility standards and strengthening regulation for relevant investment projects. Article 28 of the regulations lists requirements for investment projects for trailers, which include various semi-trailers.

[99] These requirements, which impose technical barriers and limit certain new market entrants demonstrate the GOC’s intention to promote and direct investment in certain trailer and semi-trailer products and this may have the effect of distorting market prices in the semi-trailer industry.

[100] With regard to the automotive industry, the Policy on Development of Automotive IndustryFootnote 42 provided for a foreign shareholding restriction in auto manufacturing joint ventures, which was still in force in the investigation period. Therefore, semi-trailer producers are subject to measures discriminating in favour of domestic producers.

[101] The CBSA reviewed DCVC’s response to the section 20 RFI with respect to the GOC’s economic development plans, policies and initiatives discussed above, but takes the position that even indirect influence and the cumulative impact of the GOC’s macro economic measures could have resulted in an environment where semi-trailer enterprises adhere to the government’s objectives and guidelines. Therefore, domestic prices in the semi-trailer industry in China could be affected as supply and demand are not free from intervention by a government or other authority.

GOC’s Ownership and Control of Semi-trailer Producers

[102] The core principle of Chinese economy is the socialist public ownership of the means of production. The State-owned economy is the leading force of the national economy and the State has the mandate to ensure its consolidation and growth.Footnote 43

[103] The GOC maintains structures and ensures their continued influence over enterprises, and in particular State-owned enterprises (SOEs). The GOC not only actively formulates and oversees the implementation of general economic policies by individual SOEs, but it also claims its rights to participate in operational decision-making in SOEs. In exchange, SOEs enjoy a particular status within the Chinese economy, which entails a number of economic benefits, in particular shielding from competition and preferential access to relevant resources, including financing.Footnote 44

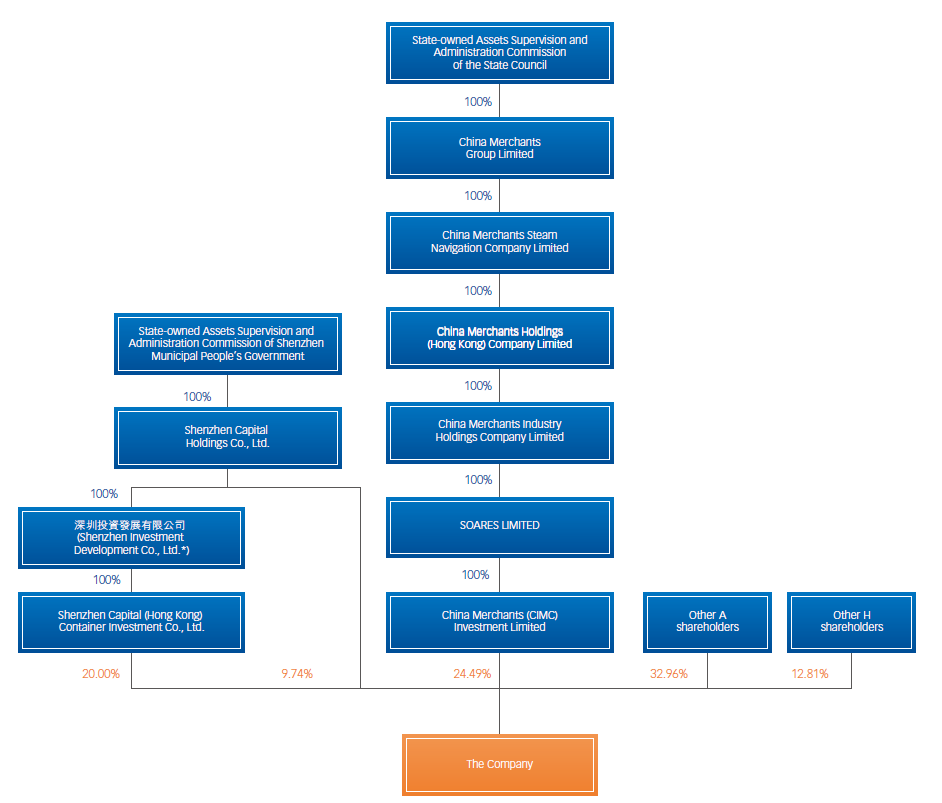

[104] The shareholding structure between CIMC and its substantial shareholders, as presented below, was illustrated in CIMC’s 2020 annual report.Footnote 45 The chart directly indicates that the SASACSC, as the largest shareholder, owns 54.2% shares through various intermediate subsidiaries.

[105] In its Public Body Analysis, the United States Department of Commerce (US DoC) explained that the GOC uses “control pyramids” to diversify SOE ownership and to profit from public listings of SOEs without relinquishing meaningful control over SOE decision-making.Footnote 46 The government maintains a controlling stake in listed firms, while minority shareholders provide financial liquidity but only achieve limited influence.Footnote 47

[106] Also as mentioned in the previous section, in a news release on August 27, 2018, the SASACSC publicly indicated that CIMC is an SOE.Footnote 48

[107] It is CBSA’s opinion that where a government entity holds a majority equity ownership, either directly or indirectly, this interest in and of itself means that the government exercises or has the potential to exercise control over the company’s operations generally. This may include control over, for example, the selection of board members and management, and the profit distribution. Information on the record reasonably supports the argument that CIMC is an SOE controlled by the GOC through multiple intermediates and ultimately by SASACSC.

GOC’s Ownership of Suppliers of Steel Materials and the Influence over Inputs

[108] The complainant states that steel products account for approximately 75% of the material inputs for container chassis.Footnote 49 Direct steel inputs in the production of subject container chassis consist of steel plate, hollow structural steel, bars and beams. Indirect steel inputs also account for a significant portion of material costs in the production of major components for semi-trailers such as wheels, suspension and axles, the prices of which are also affected by distorted steel prices in China’s domestic market.Footnote 50

[109] In the steel sector, a substantial degree of ownership by the GOC persists. The Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020)Footnote 51 indicates that the 10 largest Chinese steel companies are to have 60% of China’s crude steel output by 2025, which will likely require further state supervised acquisitions and mergers.

[110] The CBSA conducted its own research on steel production as reported by the World Steel Association. Based on the data, the top ten steel producers by volume accounted for 39% of all steel production in China in 2020.Footnote 52 Of these big ten producers, seven are state-owned, and the combined production of steel by these seven SOEs in China represents 74.4% of top 10 steel production in China in 2020. As such, the GOC has already surpassed the objectives set out in the Iron and Steel Industry Adjustment and Upgrade Plan (2016-2020) discussed above.

[111] As a result of GOC steel policies aimed at supply side structural reform, on September 22, 2016, Baosteel Group and Wuhan Steel Group consolidated by merging into BaoWu Steel Group, the largest crude steel producer in the world. The result of the merger has led to a much stronger influential state-owned entity and greater concentration in the steel industry.

[112] The GOC’s extensive ownership and control of the majority of large Chinese steel producers means that these companies likely produce and market steel according to GOC objectives and policies instead of market conditions. These large SOE steelmakers in China all are able to produce the types of steel inputs used for semi-trailer production.Footnote 53 Consequently, they can sell various steel products such as steel plate, beams and bars, directly used by semi-trailer producers, at non-market prices.

[113] Given that the state-owned steel groups also produce steel materials for wheel, axle and suspension, all of which are important assemblies to various semi-trailers including container chassis, there is a possibility that prices of semi-trailers including chassis are further affected due to the low priced steel inputs provided by large SOEs to produce various semi-trailer assemblies.

[114] The complainant presents price comparisons showing that the Chinese domestic prices for steel plate and beams, two major material inputs for container chassis, were below other benchmark markets in 2019 and 2020.Footnote 54

[115] The CBSA is able to obtain information from SteelBenchmarker which collects and analyzes ex-mills prices of plate and hot-rolled band (HRB) in China, the US and other regions, during the review period.Footnote 55 Steel plate and HRB are two main direct steel inputs in the production of container chassis. The CBSA can reasonably conclude that FOB mill prices of plate and HRB in China in the past were consistently lower than those in the USA or world average prices.

[116] Given that steel plate and HRB are commodity products freely traded on the world market, these disparities further support the allegation in the complaint that domestic prices of steel inputs in China are not the same as they would be in a competitive market.

[117] The GOC’s control and influence over steel production and pricing result in artificially low prices for steel, which likely influence prices of down stream products such as semi-trailer assemblies and semi-trailer itself including container chassis, which would benefit from the low input cost advantage.

Existence of Non-market Conditions in Sectors of other Semi-trailer Assemblies

[118] The price distortions in China of semi-trailer assemblies were recognized by the US and EU trade remedy authorities in the dumping determinations of the existence of non-market economy in Chinese wheels and tires sector.

[119] With respect to the wheels sector in China, the US DoC stated in its Less-Than-Fair-Value investigation of certain steel wheels from China in 2018:Footnote 56

Commerce considers China to be an NME (Non-Market Economy) country. In accordance with section 71(18)(C)(i) of the Act, any determination that a foreign country is an NME country shall remain in effect until revoked by Commerce.

[120] The European Union (EU) made a determination regarding exporters in China involved in certain aluminium road wheels dumping investigation:Footnote 57

The finding that all companies that had requested MET (Market Economy Treatment) should be denied MET, as established in recital (53) of the provisional Regulation is hereby confirmed.Footnote 58

[121] On March 4, 2020, the EU also concluded in its final determination in respect of steel road wheels from ChinaFootnote 59 that the steel road wheels market in China was served to a significant extent by enterprises subject to the ownership, control or policy supervision or guidance by the GOC.Footnote 60

[122] The US DoC and EU also confirmed the existence of non market conditions in the truck tire segment in China.

[123] On January 19, 2017, the US DoC continued to treat China as a non-market economy country in the final determination of dumping investigation of truck and bus tires from China.Footnote 61 In the final determination of pneumatic tyres used for buses or lorries on October 18, 2018, the EU ruled that the Chinese exporters didn’t meet the criteria for market economy treatment.Footnote 62

[124] The Catalogue of Priority Industries for Foreign Investment in Central and Western ChinaFootnote 63 is an example of the GOC’s comprehensive catalogues designed to steer foreign investment flows towards auto parts sector including driving axle and lighting systems, also components for semi-trailer production.

Manufacturing of auto parts and components: automatic transmission with six or more gears, high-power and density driving axles for commercial vehicles, adaptive front-lighting systems, LED front-lighting, application of lightweight materials (high-strength steel, aluminium-magnesium alloy, composite plastics, powder metallurgy, high-strength composite fibers, etc.), clutches, hydraulic shock absorbers, central control panel assembly and seats.

[125] The GOC guides the development of various sectors in accordance with a broad range of policy tools and directives related to market composition and restructuring, raw materials, investment, capacity elimination, product range, relocation and upgrading, etc. Through these and other means, the GOC directs and controls virtually every aspect in the development and functioning of sectors including steel wheels, road tires, axles and lighting systems.

Subsidization of the Semi-trailers, Steel Materials and Other Inputs

[126] The complainant made allegations that the GOC has subsidized chassis production, as well as relevant input materials, most notably steel inputs.

[127] Based on publically available financial statements of CIMC group, CIMC has reported having received large amounts of subsidies. In addition to over 712 million CNY of government grants recognized in profit in 2020Footnote 64, subsidies received by CIMC but to be recognized in future periods amounted to 1,176 million CYN as of December 31, 2020.Footnote 65 This represents 15.8% of CIMC’s operation profit 7,439 million CNY in 2020.Footnote 66

[128] Similarly, CIMC Vehicles reported income from government grants of over 242 million CNY in 2020Footnote 67 and accumulated over 105 million CNYFootnote 68 deferred income to be recognized in future periods as of December 31, 2020.

[129] The subsidization of container chassis production by the GOC is also evidenced by the recent findings made by the US DoC in the chassis subsidy investigation. On April 8, 2021, the US DoC issued its final determination with an increased subsidy amount from the preliminary determination to 44.32% ad valorem, applicable to CIMC and all other chassis producers in China.Footnote 69

[130] In response to the subsidy allegation by the complaint, the CBSA initiated the subsidy investigation of container chassis and made its preliminary determination on October 21, 2021, with an estimated amount of subsidy at 1.7% of export price for DCVC and 20.2% for all other Chinese exporters.

[131] Given that CIMC has been receiving large amounts of subsidies from the GOC through multiple programs, it is reasonable to conclude that similar subsidy programs could be easily available to other container chassis exporters and producers.

[132] As steel is a significant input in the production of container chassis and their steel assemblies, extensive subsidization in various steel sectors causes distorted prices of steel materials and chassis assemblies and the benefits would be both directly and indirectly passed through to container chassis producers in China. The previous positive findings of subsidized steel products in China by the CBSA including steel pipesFootnote 70, coil sheetsFootnote 71, steel barsFootnote 72 and rodsFootnote 73 are evidence of the GOC’s influence in the steel industry.

[133] Besides steel inputs, semi-trailer assemblies such as wheels and tires are found by the US DoC and EU to have been heavily subsidized by the GOC.

[134] On January 23, 2017, the US DoC announced its affirmative final determinations in countervailing duty investigation of truck and bus tires from China with a countervailing rate ranging from 38.6% to 68.5%.Footnote 74 On March 22, 2019, the US DoC made its final determinations in the countervailing duty investigations of steel wheels from China with a countervailing rate of 457.1% to mandatory respondents and all other Chinese steel wheel exporters.Footnote 75

[135] Similarly on November 13, 2018, the European Commission imposed a definitive countervailing duty on imports of new and retreaded tyres for buses or lorries from China. The rate of duty is between EUR 3.75 and 57.28 per item depending on the exporter.Footnote 76

[136] In conclusion, these direct and indirect subsidies allow Chinese container chassis producers to receive direct financial supports from the GOC and likely benefit from subsidized assemblies, which in turn would allow the chassis producers to sell their products at prices determined by factors other than the market conditions, resulting in prices possibly lower than they would be without government subsidization.

Preferential Tax Treatment

[137] The GOC provides preferential tax treatment to the purchase of container chassis in China. The Ministry of Finance issued a directive on May 25, 2018, which cut the 10% sales tax applicable to purchases of vehicles including semi-trailers by half to 5% for the period of July 1, 2018 up to June 30, 2021. The Ministry recently extended the tax break until December 31, 2023.Footnote 77

[138] The Ministry implemented this preferential tax policy measure with a stated purpose to promote the development of drop-and-pull transport, improve logistics efficiency and reduce logistics costs, guided by the GOC’s various directives and initiatives as discussed previously.

[139] In its response to the section 20 RFI, DCVC provides information about the existence and purpose of the tax reduction policy.

[140] This preferential policy of reducing the sales tax from 10% down to 5% is further evidence that the GOC can regulate the level of profits that semi-trailer companies can earn which will have an impact on domestic prices of various semi-trailers including container chassis.

Analysis of Domestic Price in China

[141] The complainant provided sample offers and prices of container chassis in the Chinese domestic market, retrieved from online marketplaces Alibaba and Diyiqi, to compare prices of similar models that closely resemble each other, sold by the complainant in Canada or sold online in some European countries.

[142] As the legal and regulatory standards for container chassis differ significantly from one jurisdiction to the other, it is difficult to select and compare identical models across the North American, Chinese and European markets. In selecting comparable models that closely resemble each other, the complainant used key characteristics: chassis length, number of axles, tare weight and gross vehicle weight rating to assess likeness of various chassis.

[143] The comparison demonstrates that container chassis prices in China are significantly lower than in Canada and European markets, suggesting the GOC’s involvement in the chassis sector is affecting its domestic prices.

[144] Price information contained in the domestic sales database of DCVC’s submission was also analyzed to assess whether the domestic price of container chassis sold by DCVC is distorted compared to other competitive markets. The result reveals that during the POI, the average price and price range of container chassis sold by DCVC were significant lower than those in the European market.

[145] Information on the record supports the allegation that the domestic prices of container chassis in China are not substantially the same as they would be if they were determined in a competitive market.

Preliminary results of the section 20 inquiry

[146] Based on the information on the record, the CBSA finds that the GOC’s policies, ownership, subsidization, tax treatment and non-market conditions in semi-trailer and/or its various inputs/assemblies sectors evidence the GOC’s involvement in and impacts on the semi-trailer sector.

[147] For the purposes of the preliminary determination of dumping, the CBSA is of the opinion that domestic prices in the semi-trailer sector of China, which includes container chassis, are substantially determined by the GOC and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[148] During the final stage of the dumping investigation, the CBSA will continue the section 20 inquiry and further verify and analyze relevant information. The CBSA may reaffirm its opinion that the conditions of section 20 of SIMA exist in the semi-trailer sector, which includes container chassis, as part of the final phase of the investigation, or conclude that the determination of normal values may be made using domestic selling prices and costs in China.

Preliminary results of the dumping investigation

Normal value

[149] For purposes of a preliminary determination, normal values are generally estimated based on the domestic selling prices of like goods in the country of export, in accordance with the methodology of section 15 of SIMA, or one of the methodologies of section 19. Where the methodology of paragraph 19(b) is used, it is based on the aggregate of the cost of production of the goods, a reasonable amount for administrative, selling and all other costs, plus a reasonable amount for profits.

[150] In the case of a prescribed country such as China, if, in the opinion of the CBSA, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market, the normal values are generally estimated on the basis of section 20 of SIMA using either the selling prices or costs of like goods in a “surrogate” country.

[151] For purposes of the preliminary determination, normal values could not be estimated on the basis of domestic selling prices in China or on the full cost of goods plus profit, because the CBSA formed the opinion that the conditions of paragraph 20(1)(a) of SIMA exist in the semi-trailer sector, which includes container chassis, in China.

[152] Where section 20 conditions exist, the CBSA may estimate normal values using the selling prices, or the total costs and profit, of like goods sold by producers in a surrogate country designated by the President in accordance with the provisions of paragraph 20(1)(c) of SIMA. However, no surrogate country producers provided the necessary domestic pricing and costing information relating to the goods under investigation.

[153] Where normal values cannot be determined under paragraph 20(1)(c), SIMA provides an alternative methodology to calculate normal values under paragraph 20(1)(d), using re-sales in Canada of like goods imported from a third country. The CBSA determined that this provision could also not be used given that the importers did not provide sufficient re-sale information.

[154] Accordingly, the CBSA has used an alternate method to estimate normal values for purposes of the preliminary determination on the basis of the best information available. This alternate method is considered to be a representative and reasonable approach and is based on a constructed cost methodology similar to that used at the initiation of the investigation and is consistent with the methodology followed by the Canadian producer in their dumping and subsidy complaint.

[155] The CBSA used the US as a surrogate for the purposes of estimating normal values, where information was available to do so. The CBSA had limited choices in selecting a comparable market and chose a surrogate based on the best available information. The US and China are the world’s largest economies by GDP. Both countries have among the largest network of roads and highways in the world. The semi-trailer industry in the US has a significant list of companies included in the Top 35 Global OEM ranking. These factors support that the prices and costs are determined in a highly competitive market, allowing them to be considered as a reliable and fair source for purposes of a preliminary determination.

[156] Although the CBSA does not have actual costs of production information from producers located in the US, it does have access to Wabash National Corporation’s (Wabash) publicly available financial statements. The CBSA estimated normal values based on the information available on the record, including information provided by the complainant and publically available information.

[157] For purposes of a preliminary determination, the normal values were estimated using a constructed cost methodology as described further below. The CBSA will endeavour to collect additional information during the final phase of the dumping investigation in order to permit the calculation of normal values based on the surrogate country methodologies referred to above.

Cost of Material

[158] There was insufficient information to estimate the cost of material based on the US, therefore the CBSA estimated the cost of material based on the complainant’s information.

[159] Based on the information available on the record, the steel frame of a container chassis is primarily made of hot-rolled steel. Since the Canadian steel market forms part of the larger and integrated North American steel market, the CBSA has considered the prices of the Canadian hot-rolled steel to be comparable to the US prices, where published benchmark data is more readily available.

[160] Accordingly, for purposes of a preliminary determination, the CBSA did not apply any adjustment to the complainant’s cost of material.

Cost of Labour

[161] There was insufficient information to estimate the cost of labour based on the US, therefore the CBSA estimated the cost of labour based on the complainant’s information.

[162] Based on publicly available information, the CBSA estimated that the cost of labour in the US closely aligns to the cost of labour in Canada. Accordingly, for purposes of a preliminary determination, the CBSA did not apply any adjustment to the complainant’s cost of labour.

Cost of Overhead

[163] There was insufficient information to estimate the cost of overhead based on the US, therefore the CBSA estimated the cost of overhead based on the complainants information.

[164] Based on the complainant’s financial information, as provided in the complaint, the CBSA estimated an amount for overhead expenses expressed as a percentage of the aggregate cost of material and labour. Similar to the cost of material referred to above, this was deemed to be the best source of information for purposes of a preliminary determination.

Amount for Administrative, Selling and All Other Costs

[165] The CBSA relied on the 2020 financial statements of Wabash National Corporation, a publicly traded semi-trailer manufacturer in the US, as a means to estimate the most reasonable amount for administrative, selling and all other costs. The amount is equal to 9.8% of the aggregate cost of material, labour, and overhead. The CBSA will continue efforts to obtain the most accurate amount for administrative, selling and all other costs during the final phase of the investigation.

Amount for Profit

[166] No information on the record was available to source a reasonable amount for profit based on 2020. This includes Canadian importers, Canadian producers as well publicly available financial statements of US producers. Due to this fact, the CBSA relied on the 2019 financial statements of Wabash National Corporation as a means to estimate the most reasonable amount for profit for purposes of a preliminary determination. The amount is equal to 5.3% of the total cost of goods. The CBSA will continue efforts to obtain a reasonable amount for profit based on 2020 during the final phase of the investigation.

Export price

[167] The export price of goods sold to importers in Canada is generally estimated in accordance with the methodology of section 24 of SIMA based on the lesser of the adjusted exporter’s sale price for the goods or the adjusted importer’s purchase price. These prices are adjusted where necessary by deducting the costs, charges, expenses, duties and taxes resulting from the exportation of the goods as provided for in subparagraphs 24(a)(i) to 24(a)(iii) of SIMA.

Margin of dumping

[168] The estimated margin of dumping by exporter is equal to the amount by which the total estimated normal value exceeds the total estimated export price of the goods, expressed as a percentage of the total estimated export price. All subject goods imported into Canada during the POI are included in the estimation of the margins of dumping of the goods. Where the total estimated normal value of the goods does not exceed the total estimated export price of the goods, the margin of dumping is zero.

Preliminary results of the dumping investigation

Dongguan CIMC Vehicle Co., Ltd.

[169] DCVC is a producer and exporter of subject goods, located in China.

[170] DCVC provided a response to the Dumping RFIFootnote 78, including a database of domestic sales of container chassis during the POI. DCVC also provided a response to the Section 20 RFIFootnote 79. The CBSA will continue to collect and verify information from DCVC during the final phase of the investigation.

[171] For the subject goods exported by DCVC to Canada during the POI, the export prices were estimated in accordance with the methodology of section 24 of SIMA based on the lesser of the adjusted exporter’s sale price for the goods or the adjusted importer’s purchase price. These prices are adjusted where necessary by deducting the costs, charges, expenses, duties and taxes resulting from the exportation of the goods as provided for in subparagraphs 24(a)(i) to 24(a)(iii) of SIMA.

[172] For the preliminary determination, the total estimated normal value compared with the total estimated export price results in an estimated margin of dumping of 57.4%, expressed as a percentage of export price.

All other exporters—China

[173] Although no evidence was found regarding other exporters who exported subject goods to Canada during the POI, provisional duties are applicable should that change during the final phase of the investigations, or should new exporters begin selling subject goods to Canada.

[174] In establishing the methodology for estimating the normal values and export prices for other potential exporters from China, the CBSA considered all of the information on the administrative record, including the complaint filed by the domestic industry, the CBSA’s estimates at the initiation of the investigation, information submitted by parties who responded to the Dumping RFI, and CBSA customs entry documentation.

[175] The CBSA decided that the normal values estimated for the exporters whose submissions were substantially complete for the preliminary determination, rather than the information provided in the complaint or estimated at initiation, would be used to establish the methodology for estimating the margin of dumping since it reflects exporters' actual trading practices during the POI. The CBSA first considered whether the information from the exporter of container chassis from China, DCVC, who provided substantially complete information was appropriate to use as the basis for estimating the margin of dumping for all other exporters in China.

[176] The CBSA examined the difference between the estimated normal value and the estimated export price for each individual transaction, and considered that the highest amount (expressed as a percentage of the export price), was an appropriate basis for estimating the margin of dumping. This methodology relies on information related to goods that originated in China and in general, provides an incentive for exporters to participate by ensuring that exporters who have provided the necessary information requested in a dumping investigation will have a more favourable outcome than those who have not participated.

[177] As a result, based on the facts available, for potential exporters that did not provide a response to the Dumping RFI, normal values of subject goods originating in or exported from China were estimated based on the highest amount by which an estimated normal value exceeded the estimated export price, on an individual transaction for the cooperative exporter during the POI. The transactions were examined to ensure that no anomalies were considered, such as very low volume and value, effects of seasonality or other business factors. No such anomalies were identified.

[178] The CBSA considered that the information submitted on the CBSA customs entry documentation was the best information on which to estimate the export price of the goods as it reflects actual import data.

[179] Using the above methodologies, for the preliminary determination, the estimated margin of dumping for all other potential exporters in China is 131.6%, expressed as a percentage of the export price.

Summary of preliminary results—dumping

[180] A summary of the preliminary results of the dumping investigation respecting all subject goods released into Canada during the POI are as follows:

| Exporter/country of origin or export | Estimated margin of dumping (% of export price) |

Estimated volume of subject goods (% of total imports) |

|---|---|---|

| Dongguan CIMC Vehicle Co., Ltd. (China) | 57.4% | 85.2% |

[181] Under section 35 of SIMA, if at any time before making a preliminary determination the CBSA is satisfied that the actual and potential volume of goods of a country is negligible, the CBSA is required to terminate the investigation with respect to goods of that country.

[182] Pursuant to subsection 2(1) of SIMA, the volume of goods of a country is considered negligible if it accounts for less than 3% of the total volume of goods that are released into Canada from all countries that are of the same description as the goods.

[183] The volume of subject goods from China is above 3% of the total volume of goods released into Canada from all countries. Based on the definition above, the volume of subject goods from China is therefore not negligible.

[184] If, in making a preliminary determination, the CBSA determines that the margin of dumping of the goods of a particular exporter is insignificant pursuant to subsection 38(1.1) of SIMA, the investigation will continue in respect of those goods but provisional duties will not be imposed on goods of the same description imported during the provisional period.

[185] Pursuant to subsection 2(1) of SIMA, a margin of dumping of less than 2% of the export price of the goods is defined as insignificant. For the exporter, the estimated margin of dumping, expressed as a percentage of the export price, is above 2% and is, therefore, not insignificant. In respect of these goods, provisional anti-dumping duties will be imposed on goods of the same description imported during the provisional period.

[186] A summary of the estimated margin of dumping and provisional duties by exporter is presented in Appendix 1.

Subsidy investigation

[187] In accordance with section 2 of SIMA, a subsidy exists if there is a financial contribution by a government of a country other than Canada that confers a benefit on persons engaged in the production, manufacture, growth, processing, purchase, distribution, transportation, sale, export or import of goods. A subsidy also exists in respect of any form of income or price support within the meaning of Article XVI of the General Agreement on Tariffs and Trade, 1994, being part of Annex 1A to the World Trade Organization (WTO) Agreement that confers a benefit.

[188] Pursuant to subsection 2(1.6) of SIMA, there is a financial contribution by a government of a country other than Canada where:

- practices of the government involve the direct transfer of funds or liabilities or the contingent transfer of funds or liabilities

- amounts that would otherwise be owing and due to the government are exempted or deducted or amounts that are owing and due to the government are forgiven or not collected

- the government provides goods or services, other than general governmental infrastructure, or purchases goods or

- the government permits or directs a non-governmental body to do anything referred to in any of paragraphs (a) to (c) where the right or obligation to do the thing is normally vested in the government and the manner in which the non-governmental body does the thing does not differ in a meaningful way from the manner in which the government would do it

[189] Where subsidies exist, they may be subject to countervailing measures if they are specific in nature. According to subsection 2(7.2) of SIMA a subsidy is considered to be specific when it is limited, in a legislative, regulatory or administrative instrument, or other public document, to a particular enterprise within the jurisdiction of the authority that is granting the subsidy; or is a prohibited subsidy.

[190] A “prohibited subsidy” is either an export subsidy or a subsidy or portion of a subsidy that is contingent, in whole or in part, on the use of goods that are produced or that originate in the country of export. An export subsidy is a subsidy or portion of a subsidy contingent, in whole or in part, on export performance. An “enterprise” is defined as including a group of enterprises, an industry and a group of industries. These terms are all defined in section 2 of SIMA.

[191] Notwithstanding that a subsidy is not specific in law, under subsection 2(7.3) of SIMA a subsidy may also be considered specific having regard as to whether:

- there is exclusive use of the subsidy by a limited number of enterprises